sarabeths-campaign.site

Market

Fifth Third Bank Near Me Now

Online & Mobile Banking · Credit Cards. Nearby Locations. Find Another Location. Branch & ATM. Fifth Third Bank Taylor Square. Taylor Road SW. Reynoldsburg. Find a Fifth Third Bank branch or ATM. Get location hours, directions, customer service numbers, and available banking services including surcharge-free. It's easy with Fifth Third online and mobile banking. With our mobile app, you can check balances, transfer money, deposit checks and more. LOCATIONS & HOURS. Stop in and see us. Find Branches & ATMs by mapping The color coded transactions (red for deductions, green for deposits) is now a uniform. Fifth Third operates 15 affiliates with more than full-service locations. Visit to find out about the regions we serve! Visit now to learn about TD Bank 14th & 5th located at 90 5th Avenue, New York, NY. Find out about hours, in-store services, specialists, & more. Fifth Third operates 15 affiliates with more than full-service locations. Visit to find out about the regions we serve! We can help you with checking, savings, credit cards, mobile banking, and more at Fifth Third Bank in Algonquin, IL. Visit us at the Algonquin location today. Find a Fifth Third Bank location in Chicago, IL and discover the personal or small business banking solutions to meet your needs. Stop in today! Online & Mobile Banking · Credit Cards. Nearby Locations. Find Another Location. Branch & ATM. Fifth Third Bank Taylor Square. Taylor Road SW. Reynoldsburg. Find a Fifth Third Bank branch or ATM. Get location hours, directions, customer service numbers, and available banking services including surcharge-free. It's easy with Fifth Third online and mobile banking. With our mobile app, you can check balances, transfer money, deposit checks and more. LOCATIONS & HOURS. Stop in and see us. Find Branches & ATMs by mapping The color coded transactions (red for deductions, green for deposits) is now a uniform. Fifth Third operates 15 affiliates with more than full-service locations. Visit to find out about the regions we serve! Visit now to learn about TD Bank 14th & 5th located at 90 5th Avenue, New York, NY. Find out about hours, in-store services, specialists, & more. Fifth Third operates 15 affiliates with more than full-service locations. Visit to find out about the regions we serve! We can help you with checking, savings, credit cards, mobile banking, and more at Fifth Third Bank in Algonquin, IL. Visit us at the Algonquin location today. Find a Fifth Third Bank location in Chicago, IL and discover the personal or small business banking solutions to meet your needs. Stop in today!

Find a Fifth Third Bank location in Naples, FL and discover the personal or small business banking solutions to meet your needs. Stop in today! Find a Fifth Third Bank location in Louisville, KY and discover the personal or small business banking solutions to meet your needs. Stop in today! Browse all Fifth Third Bank branch & ATMs locations across the 10 states we serve. Find a location offering personal banking and lending solutions tailored. It's easy with Fifth Third online and mobile banking. With our mobile app, you can check balances, transfer money, deposit checks and more. Fifth Third Bank. in Cincinnati, OH ; Harpers Point Bank Mart. Montgomery Road · ; Sharonville. Lebanon Road · ; Tri-County. West Kemper. Fifth Third Bank. in Cincinnati, OH ; Harpers Point Bank Mart. Montgomery Road · ; Sharonville. Lebanon Road · ; Tri-County. West Kemper. Fifth Third Arena, during public skate hours, subject to capacity limitations. FIFTH THIRD BANK CUSTOMER PERK. Are you a Fifth Third Bank Customer? Show. Customers of Fifth Third Bank can use their Fifth Third debit, ATM or prepaid card to conduct transactions fee-free from ATMs listed on our ATM locator on It seems good, and it's done well for the 10 hours I've had it (mobile banking app). But now im hearing online (tiktok) about complaints. Something about. Headquartered in Cincinnati, Ohio, we are among the largest money managers in the Midwest. We operate four main businesses—Commercial Banking, Branch Banking. Fifth Third Bank in Columbus, OH. Branch & ATM. Fifth Third Bank Bethel Road. Bethel Road. Columbus, OH phone () You can also call us toll free at or visit a Fifth Third Branch near you. Fifth Third mobile app, on Android and iPhone. Fron the Fifth Third. We'll help you find a solution that fits your unique financial needs. Find out how we can help you with checking, savings, credit cards, mobile banking, and. The annual Fifth Third Bank Summer Concerts at Meijer Gardens continues to bring the finest national and international musicians to West Michigan. Fifth Third Bank, National Association is one of the top-performing banks in the country, with a history that spans more than years. Find 5 listings related to Fifth Third Bank in Bronx on sarabeths-campaign.site See reviews, photos, directions, phone numbers and more for Fifth Third. Hours. Sun. Closed. Mon AM - PM. Tue AM - PM. Wed "William provides excellent customer service for me today. He was extremely. Fifth Third Stadium is the home of the Kennesaw State Owls (soccer, lacrosse and football) and Atlanta United 2 (professional soccer). Fifth Third Bank (5/3 Bank), the principal subsidiary of Fifth Third Bancorp, is a bank holding company headquartered in Cincinnati, Ohio. Fifth Third Bank & ATM · Hours · Photos · Also at this address · Find Related Places · You might also like.

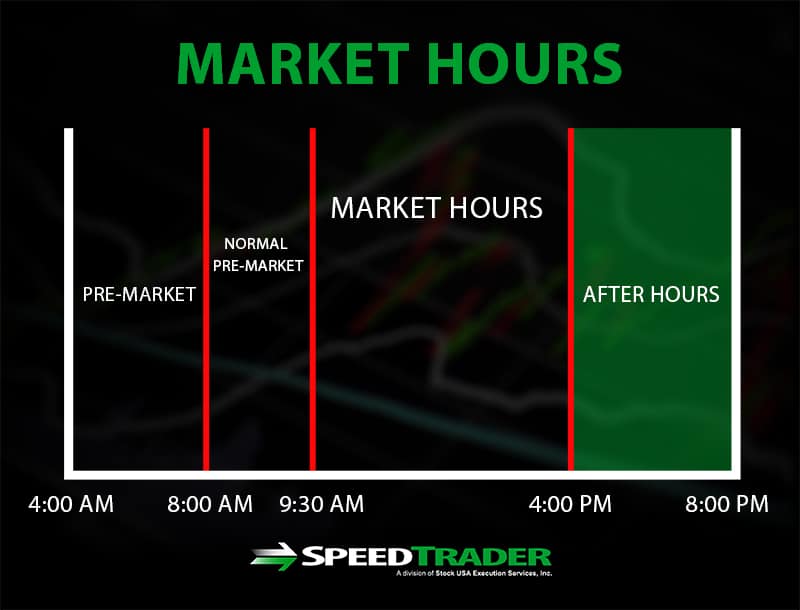

What Are After Hours In The Stock Market

After-hours trading refers to the period of time after the market closes and during which an investor can place an order to buy or sell stocks or ETFs. Stocks that are moving in the after hours trading period from PM to PM. See top gainers and top losers. After-hours trading occurs after the markets close. There is also a session prior to the market's open which is called the pre-market session. In India, the stock market is open for regular trade from AM to PM. After hours trading is allowed from PM to 4 PM. Around the world, stocks. Definition of After Hours Trading. After hours trading means buying and selling securities after the end of regular market hours. In India, the stock market is. Post-market hours are from 4 pm to 8 pm ET. To trade U.S. stocks and ETFs during extended market hours, the following conditions apply: The order must be. After hours is essentially the same as during the day except there is much less trading going on so the price will fluctuate less. Stock After Hours Trading Report · Stocks with positive price gaps from the day's closing price · Stocks experiencing large price declines · Most actively traded. After-hours trading, as the name suggests, takes place after the markets close. For U.S. stock markets, after-hours trading starts at 4 p.m. and can run as late. After-hours trading refers to the period of time after the market closes and during which an investor can place an order to buy or sell stocks or ETFs. Stocks that are moving in the after hours trading period from PM to PM. See top gainers and top losers. After-hours trading occurs after the markets close. There is also a session prior to the market's open which is called the pre-market session. In India, the stock market is open for regular trade from AM to PM. After hours trading is allowed from PM to 4 PM. Around the world, stocks. Definition of After Hours Trading. After hours trading means buying and selling securities after the end of regular market hours. In India, the stock market is. Post-market hours are from 4 pm to 8 pm ET. To trade U.S. stocks and ETFs during extended market hours, the following conditions apply: The order must be. After hours is essentially the same as during the day except there is much less trading going on so the price will fluctuate less. Stock After Hours Trading Report · Stocks with positive price gaps from the day's closing price · Stocks experiencing large price declines · Most actively traded. After-hours trading, as the name suggests, takes place after the markets close. For U.S. stock markets, after-hours trading starts at 4 p.m. and can run as late.

The pre-market trades can be made between am and am Eastern Time, while the after-hours trading session runs from pm to pm Eastern Time. How. Check out what's happening in U.S. markets during after hours trading on CNBC Global Business and Financial News, Stock Quotes, and Market Data and Analysis. After-hours stock trading occurs after the regular stock market hours— am to pm ET—are over. After-hours stock trading takes place between the hours. Biggest movers among U.S.-listed issues outside of regular trading hours with a minimum share price of $2 and minimum pre-market or after-hours volume of. Overnight trading session (EXTO) orders are hour continuous orders that expire at 8 p.m. ET every market day. Overnight trading sessions are available for. US Stock Market Hours for Equity and Equity Options ; Eastern Standard Time (EST) - New York, AM, PM ; Central Standard Time (CST) - Chicago, 8. US stocks below gained the most in price during the post-market session. They are sorted by post-market price percentage change and supplied with other. Time Period: After-hours trading occurs after the official market closing time and extends for a few hours. The exact duration of after-hours trading can vary. After-hours trading (AHT), also known as extended hours trading, is the buying and selling of securities after the major markets have closed. After hours trading refers to the time outside regular trading hours when an investor can buy and sell securities. The main exchanges in the United States. After-hours trading, also known as extended-hours trading, refers to trading that occurs outside of regular trading hours. Regular trading hours for stocks. After-hours ; Dow Futures. 40, - ; S&P Futures. 5, - ; NASDAQ Futures. 18, + After-hours trading is the name for buying and selling of securities when the major markets are closed. Since , the regular trading hours for major. Monitor leaders, laggards and most active stocks during after-market hours trading. After-hours trading refers to the extended trading session that takes place after the official closing of a stock exchange. Dive into after-hours trading: Explore its convenience, opportunities, and risks to make informed investment decisions beyond traditional trading hours. All times are Eastern Time. *** Each market will close early at p.m. ( p.m. for eligible options) on Tuesday, December 24, Sorted by post-market volume, US stocks below were traded the most actively in the after-hours session. After-hours trading occurs when the normal hours of the stock exchange end and the market closes for the day. Pre-market and After-hours Trading in the Stock Market – Peculiarities of Trading · Pre-market trading is the time before a trading session opens. · Pre-market.

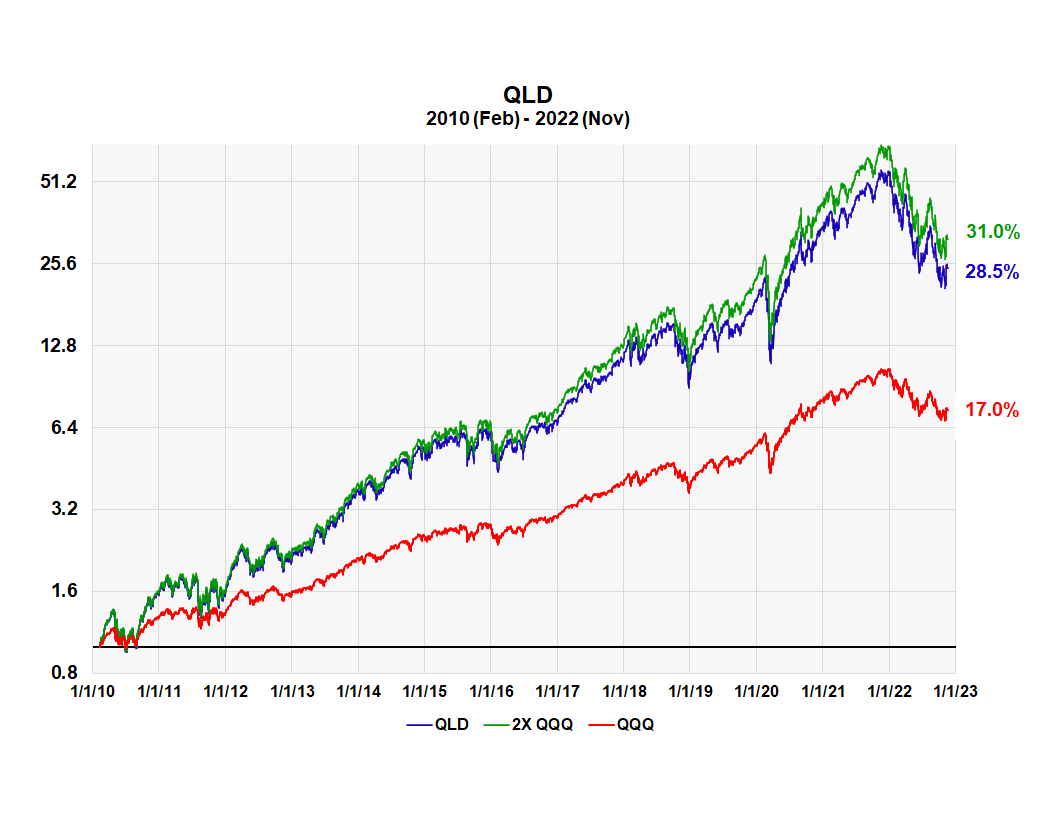

Qqq Etf Forecast

Invesco QQQ Trust QQQ:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/10/24 · 52 Week Low · QQQ is a fund containing stocks from the top companies traded on the nasdaq exchange. Can you narrow down your question? This comment is. What was QQQ's price range in the past 12 months? QQQ lowest ETF price was $ and its highest was $ in the past 12 months. · What is the AUM of QQQ? U.S. News evaluated Large Growth ETFs and 34 make our Best Fit list. Our list highlights the best passively managed funds for long-term investors. Rankings. Given the current short-term trend, the ETF is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. ETF To Buy Based on Deep Learning: Returns up to % in 1 Year. August 22, · 1 Year (8/21/23 - 8/21/24) ; Dividend Stocks Based on Artificial Intelligence. Invesco QQQ stock price forecast for September In the beginning at Maximum , minimum The averaged price NasdaqGM - Nasdaq Real Time Price • USD. Invesco QQQ Trust (QQQ). Follow. sarabeths-campaign.site • 11 days ago. View More. Research Reports: QQQ. View More. Solid. The forecasted Invesco QQQ price at the end of is $ - and the year to year change +30%. The rise from today to year-end: +7%. In the first half of Invesco QQQ Trust QQQ:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/10/24 · 52 Week Low · QQQ is a fund containing stocks from the top companies traded on the nasdaq exchange. Can you narrow down your question? This comment is. What was QQQ's price range in the past 12 months? QQQ lowest ETF price was $ and its highest was $ in the past 12 months. · What is the AUM of QQQ? U.S. News evaluated Large Growth ETFs and 34 make our Best Fit list. Our list highlights the best passively managed funds for long-term investors. Rankings. Given the current short-term trend, the ETF is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. ETF To Buy Based on Deep Learning: Returns up to % in 1 Year. August 22, · 1 Year (8/21/23 - 8/21/24) ; Dividend Stocks Based on Artificial Intelligence. Invesco QQQ stock price forecast for September In the beginning at Maximum , minimum The averaged price NasdaqGM - Nasdaq Real Time Price • USD. Invesco QQQ Trust (QQQ). Follow. sarabeths-campaign.site • 11 days ago. View More. Research Reports: QQQ. View More. Solid. The forecasted Invesco QQQ price at the end of is $ - and the year to year change +30%. The rise from today to year-end: +7%. In the first half of

The better of these two ETFs will largely depend on your market outlook and time horizon. For long-term buy-and-hold investors, the QQQ is a good choice to. Invesco QQQ allows investors to access the Nasdaq—some of today's most dynamic companies, all in one exchange-traded fund (ETF). Trending ETFs ; QQQ. Invesco Qqq Trust, Series 1. $ + +% ; SPY. Spdr S&P Etf Trust Units. $ + +% ; SCHD. Schwab U.S. Dividend. Move on QQQ ETF: XLT and IYM are firing on all cylinders. Invesco QQQ ETF (QQQ) has become the biggest technology ETFs with over $ billion in assets. It has. Find the latest Invesco QQQ Trust, Series 1 QQQ analyst stock forecast, price target, and recommendation trends with in-depth analysis from research reports. Invesco QQQ Trust (QQQ) - stock quote, history, news and other vital information to help you with your stock trading and investing. POWER INFLOW ALERT: QQQ GENERATES SIGNAL & SHARES RISE % ; SPDR S&P ETF Trust. SPY ; iShares Core S&P ETF. IVV ; Vanguard Total Stock. Invesco QQQ Trust QQQ:NASDAQ ; $, + (%), 21,, Average ; As of pm ET 08/30/ The ProShares Ultra QQQ ETF holds sell signals from both short and long-term Moving Averages giving a more negative forecast for the stock. On corrections up. Read the latest Nasdaq news, analysis and forecasts for expert trading insights. Get QQQ Nasdaq ETF price data, news, charts and performance. Invesco QQQ — the ETF that tracks the Nasdaq index — has beaten the S&P eight out of the last 10 years as of June 30, Performance and alpha after 1, 3, and 6 months, for each of the undefined days that QQQ was rated a Buy/Strong Buy (AI Score 7 to 10) since January Date. Explore QQQ for FREE on ETF Database: Price, Holdings, Charts, Technicals forecast or prediction. None of the Information can be used to determine. With an AI score of 52, the QQQ stock forecast suggests stability. What is the QQQ price prediction for ? To predict the price for QQQ in , we can. The Fund seeks to provide investment results that generally correspond to the price and yield performance of the Nasdaq Index. Investment Policy. The Fund seeks to provide investment results that generally correspond to the price and yield performance of the Nasdaq Index. It's difficult to predict but a case could be made that the Nasdaq, which is tracked by Invesco QQQ ETF (also known as Invesco QQQ), could be the index of. Should You Buy or Sell Invesco QQQ Stock? Get The Latest QQQ Stock Price, Constituents List, Holdings Data, Headlines, and Short Interest at MarketBeat. The forecast for beginning dollars. Maximum price , minimum Averaged Invesco QQQ stock price for the month At the end dollars, change for. The successful prediction of Invesco QQQ's future price could yield a significant profit. We analyze noise-free headlines and recent hype associated with.

What Is Covered Bond

Covered bonds are a senior secured debt instruments typically issued by a bank. In addition to the recourse to the issuer a covered bond investor also has a. Covered Bonds are asset-backed debt instruments issued by lenders like banks and NBFCs (Non-Banking Financial Company). The asset that backs (or secures). Covered bonds are debt instruments secured by a cover pool of mortgage loans (property as collateral) or public-sector debt to which investors. Covered Bonds are a hybrid between asset-backed securities/mortgage-backed securities and normal secured Covered Bonds. Mortgage lenders primarily use them and. Access prospectuses, final terms and documentation related to Barclays' regulated covered bonds programme. In covered bonds, dual recourse means that bondholders have two sources of repayment: the issuer of the bond (a bank or building society), and the cover pool of. A covered bond is a debt instrument that is secured by a pledge of a segregated pool of assets (a “cover pool”), but is paid back from an issuer's cash flow. Fitch maintains ratings and issues insightful research for over covered bond programs from more than 20 countries – accounting for roughly billion. A covered bond is a financial instrument comprising a pool of assets, such as mortgage loans and public sector loans, issued by banks. These bonds, with a. Covered bonds are a senior secured debt instruments typically issued by a bank. In addition to the recourse to the issuer a covered bond investor also has a. Covered Bonds are asset-backed debt instruments issued by lenders like banks and NBFCs (Non-Banking Financial Company). The asset that backs (or secures). Covered bonds are debt instruments secured by a cover pool of mortgage loans (property as collateral) or public-sector debt to which investors. Covered Bonds are a hybrid between asset-backed securities/mortgage-backed securities and normal secured Covered Bonds. Mortgage lenders primarily use them and. Access prospectuses, final terms and documentation related to Barclays' regulated covered bonds programme. In covered bonds, dual recourse means that bondholders have two sources of repayment: the issuer of the bond (a bank or building society), and the cover pool of. A covered bond is a debt instrument that is secured by a pledge of a segregated pool of assets (a “cover pool”), but is paid back from an issuer's cash flow. Fitch maintains ratings and issues insightful research for over covered bond programs from more than 20 countries – accounting for roughly billion. A covered bond is a financial instrument comprising a pool of assets, such as mortgage loans and public sector loans, issued by banks. These bonds, with a.

Covered Bond. A bond that is backed or covered by a pool of mortgages or other assets, which mortgages or assets remain on the balance sheet of the issuing bank. Covered bonds are similar to bonds issued under a securitisation, except that bondholders under a covered bond have recourse to both the pool of assets backing. The term “covered bond” means a bond issued under this Act, whose holder can excercise the right to repayment against an issuer, and the principal and interest. Over-collateralisation is the most important piece of protection in covered bonds demanded by investors, supervisors and rating agencies. It essentially. Covered bonds are debt obligations issued by credit institutions which offer a so-called double-recourse protection to bondholders: if the issuer fails, the. In the case of Xtrackers, covered-bond ETFs (like all fixed-income ETFs) exclusively invest in bonds with high creditworthiness and then SWAP the performance of. Covered Bond. Share. Advertisement. A covered bond is a type of bond which is secured by collateral held as segregated assets. If bankruptcy or some other. Covered bonds are debt instruments that have recourse either to the issuing entity or to an affiliated group to which the issuing entity belongs, or both, and. The covered bonds offered under the Programme have not been approved or disapproved by the Canada Mortgage and Housing Corporation (“CMHC”) nor has CMHC passed. This criteria report describes Fitch Ratings' global methodology for assigning and monitoring credit ratings for covered bond obligations. Covered bonds are debt securities issued by banks, guaranteed by a highly secure cover pool consisting of mortgage loans and loans to local authorities. Covered bonds provide dual recourse to both the cover pool and the issuer. In the event of an issuer default, covered bond investors first have recourse to the. We highlight two opposing effects of asset encumbrance and covered bond issuance on the incidence of bank runs. The first is a bank funding channel: the. Covered bonds are similar to bonds issued under a securitisation, except that bondholders under a covered bond have recourse to both the pool of assets backing. Thanks to the long estabished links to issuers and investors worldwide, London Stock Exchange is a global leader for the issuance of covered bonds. Covered bonds provide dual recourse, unlike secured corporate bonds that only offer recourse against the issuer. This means that investors have a first recourse. The reason for the market success of covered bonds is their exceptional security, which results in certain privileges specified in banking, insurance or. They are similar in many ways to Asset-backed Securities, but Covered Bond Receivables remain on the Originator's balance sheet, and hence Secured Creditors are. Thanks to the long estabished links to issuers and investors worldwide, London Stock Exchange is a global leader for the issuance of covered bonds. Here we present the Riksbank's total holdings of covered bonds. The holdings are the net total of covered bonds purchased, which is to say the total sum of.

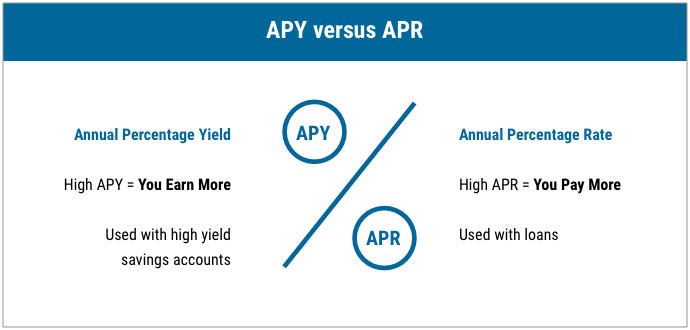

How Savings Apy Works

Compound interest is your friend, which is why annual percentage yield (APY) is so important. The official APY definition is the interest rate (aka “rate of. The details of how compound interest works will vary from bank to bank and account to account. To properly leverage your savings, it's helpful to understand how. With most savings accounts and money market accounts, you'll earn interest every day, but interest is typically paid to the account monthly.4 However, CDs. Annual Percentage Yield (APY) reflects the effect of compounding frequency (Savings What it is, how it works and everything in between. High Yield. The primary feature that sets high-yield savings accounts apart is their interest rate. While traditional savings accounts might offer interest rates around. Simple interest is just that and is typically used with savings bonds. It means if you invest $1, at 5% interest, at the end of the year you will receive a. Annual Percentage Yield (APY) is the percentage reflecting the total amount of interest paid on an account based on the interest rate and frequency of. You will earn interest no matter how much money you have in your account. That means your savings will start growing right away! save. APY tells you how much interest you can earn on savings and includes compound interest. What is APR? APR applies to borrowing money, such as with a loan or. Compound interest is your friend, which is why annual percentage yield (APY) is so important. The official APY definition is the interest rate (aka “rate of. The details of how compound interest works will vary from bank to bank and account to account. To properly leverage your savings, it's helpful to understand how. With most savings accounts and money market accounts, you'll earn interest every day, but interest is typically paid to the account monthly.4 However, CDs. Annual Percentage Yield (APY) reflects the effect of compounding frequency (Savings What it is, how it works and everything in between. High Yield. The primary feature that sets high-yield savings accounts apart is their interest rate. While traditional savings accounts might offer interest rates around. Simple interest is just that and is typically used with savings bonds. It means if you invest $1, at 5% interest, at the end of the year you will receive a. Annual Percentage Yield (APY) is the percentage reflecting the total amount of interest paid on an account based on the interest rate and frequency of. You will earn interest no matter how much money you have in your account. That means your savings will start growing right away! save. APY tells you how much interest you can earn on savings and includes compound interest. What is APR? APR applies to borrowing money, such as with a loan or.

The official APY definition is the interest rate (aka “rate of return”) on a deposit account based on a compounding period of one year. Both APR and APY are used by financial institutions to describe interest rates. The main difference is the compounding periods. Generally speaking, financial. How Does Compound Interest Work? Compounding happens at defined periods, usually daily or monthly. More frequent compounding (daily) results in higher returns. High-yield savings accounts offer higher interest rates than regular accounts. You can deposit and withdraw money with ease, providing flexibility. APY reflects the actual rate of return on your savings and investments, depending on how frequently interest is calculated - daily, monthly, or quarterly. APY tells you how much interest you will earn on a deposit account in a year. · Interest rate is the percentage of the savings account balance the bank will pay. How does Annual Percentage Yield Work for Business Investments? When a business invests in a financial product with a specific APY, it calculates the total. Compared to APR, APY provides a more accurate representation of how much interest your account will earn in a given year. How Do Online Savings Accounts Work? The Annual Percentage Yield (APY) is accurate as of 8/28/ This is a tiered, variable rate account. The interest rate and corresponding APY for savings and. To incorporate compound interest, financial institutions will display a savings account's annual percentage yield, or APY, which demonstrates interest rate plus. When a bank tells you its APY, or annual percentage yield, it's sharing how much your money can grow when on deposit for a year. On the other hand, APR stands. Compound interest on a savings account is calculated on principal and earned interest from previous periods. Essentially your earnings are reinvested and future. Compounding interest: Interest Rate vs. APY Like savings accounts, CDs earn compound interest—meaning that periodically, the interest you earn is added to. Simply put, annual percentage yield (APY) is the amount of interest earned on a savings account in one year. It takes into account compounding interest. The Annual Percentage Yield (APY) is accurate as of 8/28/ This is a tiered, variable rate account. The interest rate and corresponding APY for savings and. Interest is calculated by multiplying the daily interest rate (based on the applicable annual rate) by the daily closing balance of your account and is paid. Using APY to Compare Deposit Accounts When shopping for a CD or savings account, the best way to compare options is by looking at APY. APY considers both the. Each month, you also begin to earn compound interest on your savings account. Unless your rate changes during the year, your daily periodic rate will remain the. The interest rate paid depends on the total daily closing balance. Interest rate is applied to the entire balance, calculated daily, and paid monthly. Regular. All customers earn % APY on Pay Autosave and ONE@Work Save balances up to $, All other Savings balances will earn % APY. In all instances, %.

Difference Between A Secured And An Unsecured Loan

With a secured personal loan, your credit union uses your savings as collateral for the loan. But with an unsecured personal loan, you don't have to put up any. A secured loan requires you to provide the lender with an asset that will be used as a collateral for the loan. Whereas and unsecured loan doesn't require you. ° Secured loans: Loans in which your property (things you own) is used as collateral; if you cannot pay back the loan, the lender takes your collateral to get. The main difference between secured and unsecured loans is collateral. While secured loans involve collateral, unsecured loans don't require you to put up. Secured loans require that you offer up something you own of value as collateral in case you can't pay back your loan, whereas unsecured loans allow you borrow. For a secured loan, your credit union will hold some of your funds as collateral until your loan is paid in full. For an unsecured loan, you don't need to put. The main difference between a secured loan and an unsecured loan is whether the lender requires security. The primary difference between secured and unsecured personal loans is the presence of collateral. A secured loan requires that you use one of your assets as. If you take out a loan to buy business-related assets, but default on your payments, the finance company may repossess the assets and resell them. Yet again we. With a secured personal loan, your credit union uses your savings as collateral for the loan. But with an unsecured personal loan, you don't have to put up any. A secured loan requires you to provide the lender with an asset that will be used as a collateral for the loan. Whereas and unsecured loan doesn't require you. ° Secured loans: Loans in which your property (things you own) is used as collateral; if you cannot pay back the loan, the lender takes your collateral to get. The main difference between secured and unsecured loans is collateral. While secured loans involve collateral, unsecured loans don't require you to put up. Secured loans require that you offer up something you own of value as collateral in case you can't pay back your loan, whereas unsecured loans allow you borrow. For a secured loan, your credit union will hold some of your funds as collateral until your loan is paid in full. For an unsecured loan, you don't need to put. The main difference between a secured loan and an unsecured loan is whether the lender requires security. The primary difference between secured and unsecured personal loans is the presence of collateral. A secured loan requires that you use one of your assets as. If you take out a loan to buy business-related assets, but default on your payments, the finance company may repossess the assets and resell them. Yet again we.

These loans are called “secured” because the bank has protection against risk. If a borrower doesn't repay the loan, the lender gets the house, car or other. Secured Vs Unsecured Loans · Secured loans are protected by an asset (collateral). · Unsecured loans require no collateral. · Secured loans allow you to borrow. An easy way to think of it is this: a secured loan uses collateral where an unsecured loan doesn't. But we'll give you more than that. Secured loans get tied to an asset, like your home or automobile. Unsecured loans are not tied to any specific asset. Understanding these types of loans in more. A secured loan requires borrowers to offer a collateral or security against which the loan is provided, while an unsecured loan does not. This difference. ° Secured loans: Loans in which your property (things you own) is used as collateral; if you cannot pay back the loan, the lender takes your collateral to get. A secured loan is money borrowed or 'secured' against an asset you own, such as your home, whereas an unsecured loan isn't tied to an asset. When it comes to secured vs unsecured loans, the biggest difference is what happens if you can't pay up. With a secured loan, like a mortgage or. Secured loans are protected by an asset (collateral). · Unsecured loans require no collateral. · Secured loans allow you to borrow large amounts of money — for. A secured loan is when a borrower has to offer collateral against the funds. While availing unsecured loans, on the other hand, there is no requirement to. Secured debts are generally viewed as having a lower risk for lenders than unsecured debts. For example, if a secured debt goes into default, the collateral. The main difference between secured and unsecured loans is collateral. While secured loans involve collateral, unsecured loans don't require you to put up. Advantages of Secured Loans · You can borrow larger amounts because lenders are confident that they will get their money back, either from loan repayments or. A secured loan usually means the lender can take your home if you fail to repay. Unsecured personal loans are less risky, but you'll still need to repay on. A secured loan is a type of loan where the lender requires the borrower to put up certain assets as a surety for the loan. Secured loans are tied to an asset, like your home or automobile. Unsecured loans are not tied to any specific asset. The higher the risk, the higher rate you will pay, and if the risk is too high they won't lend at all. With an Unsecured Loan, the lender will make a judgement. Compare secured vs unsecured loans for personal and business finance. Explore advantages and disadvantages of secured and unsecured borrowing features. Secured loans are backed by collateral and tend to have lower interest rates, higher borrowing limits and fewer restrictions than unsecured loans. The main difference between secured loans and unsecured loans is the presence or absence of collateral.

Honda Used Car Warranty Cost

You can add a Honda vehicle protection plan to your purchase to extend the coverage provided by your factory warranty after the first three years. On top of. Honda Certified Used Cars Limited Warranty Vehicle History Report on every vehicle, free of cost to you. Honda Plus Warranty ; First Period of Coverage. 4 yr / , km. 5 yr / , km ; Civic & Fit · $ $1, ; Accord L4 · $ $1, ; Accord V6, CR-V &. Other Pre-Owned vehicles selling for $11, or more come with a 6 month/6, mile warranty at no cost to you. 5 DAY PRE-OWNED VEHICLE EXCHANGE POLICY. Buying. Warranty period: extends New Vehicle Limited Warranty to 4 years4 /48, miles5. For vehicles purchased after New Vehicle Limited Warranty has expired: Honda. Features. HondaTrue Certified+. vehicles · HondaTrue Certified. vehicles ; Limited Warranty. Powertrain Coverage. 7 years4/, miles · Non-. WARRANTIES AND ADDITIONAL COVERAGEWARRANTIES AND ADDITIONAL COVERAGE. Standard Warranty · Honda Plus Extended Warranty · Coverage New Comprehensive · Coverage. We run a Vehicle History Report at no cost to you to assure that The Honda Certified Used Cars Limited Warranty extends the non-powertrain coverage. Honda Care is the only factory backed extended coverage. Get a real Honda service contract before your warranty expires. You can add a Honda vehicle protection plan to your purchase to extend the coverage provided by your factory warranty after the first three years. On top of. Honda Certified Used Cars Limited Warranty Vehicle History Report on every vehicle, free of cost to you. Honda Plus Warranty ; First Period of Coverage. 4 yr / , km. 5 yr / , km ; Civic & Fit · $ $1, ; Accord L4 · $ $1, ; Accord V6, CR-V &. Other Pre-Owned vehicles selling for $11, or more come with a 6 month/6, mile warranty at no cost to you. 5 DAY PRE-OWNED VEHICLE EXCHANGE POLICY. Buying. Warranty period: extends New Vehicle Limited Warranty to 4 years4 /48, miles5. For vehicles purchased after New Vehicle Limited Warranty has expired: Honda. Features. HondaTrue Certified+. vehicles · HondaTrue Certified. vehicles ; Limited Warranty. Powertrain Coverage. 7 years4/, miles · Non-. WARRANTIES AND ADDITIONAL COVERAGEWARRANTIES AND ADDITIONAL COVERAGE. Standard Warranty · Honda Plus Extended Warranty · Coverage New Comprehensive · Coverage. We run a Vehicle History Report at no cost to you to assure that The Honda Certified Used Cars Limited Warranty extends the non-powertrain coverage. Honda Care is the only factory backed extended coverage. Get a real Honda service contract before your warranty expires.

Features. HondaTrue Certified+ · HondaTrue Certified ; Limited Warranty. Powertrain Coverage 7 years4/, miles · Non-Powertrain Coverage For vehicles. If your vehicle develops a problem you feel should be repaired by American Honda at no cost, discuss it with your dealer. If you are not satisfied with your. At no extra cost to you, Royal Honda offers Lifetime Warranty, a non-factory, limited powertrain service warranty on all new and qualifying used vehicles. At no extra cost to you, Honda Morristown offers Lifetime Warranty, a non-factory, limited powertrain service warranty on all new and qualifying used vehicles. Honda Plus Extended Warranty · Coverage New Comprehensive · Coverage There is no cost to transfer the contract from you to the purchaser of your vehicle. Honda owners can get a free extended care warranty quote online, by calling, or in person. Get a free quote online by submitting the form that only requires the. Benefits that work for you. ; Duration of limited warranty ; Remainder from original warranty ; Duration of powertrain warranty. Honda or select pre-owned vehicle. This warranty costs you nothing Our No Cost Lifetime Limited Powertrain Warranty is eligible on all new and all used. That's why we offer a Lifetime Warranty on every new Honda at no additional cost. Anything we can do to give you peace of mind during the car buying process is. Engine, Cylinder Block, Internal Parts, Transmission, Drive System, Transaxle – all covered at no extra cost! Your certified pre-owned vehicle warranty is valid. Every new and most pre-owned vehicles include a real, nationwide lifetime warranty, valid anywhere in the US and Canada at no additional cost. insurance claims, and personal item replacement services. Explore Honda Care Extended Warranty Options with Honda Universe! Ready for the peace of mind you. New Honda vehicles are covered by a 3-Year/36,Mile Limited Warranty, plus a 5-Year/60,Mile Powertrain Limited Warranty. Honda Genuine Accessories. Honda also adds seven years/, miles of powertrain warranty. Miller Honda is proud to offer these warranties to you at no extra cost. Vehicle History. Our Lifetime Powertrain Warranty is back by an A-rated insurance company with a national reputation for integrity and commitment to outstanding customer. The New Vehicle Limited Warranty is a warranty designed to cover replacement costs for all major parts and components on a new Honda, including the tires. You can also find competitive prices on Honda certified pre-owned cars at our Honda dealership near Los Angeles. Every CPO Honda has undergone a quality. When you choose a Honda certified pre-owned vehicle, it automatically comes with an extended warranty. Although CPOs usually cost more upfront than other pre-. When you buy a Honda CPO vehicle, you not only get a pristine car with a great warranty, you also get a special financing rate on select models when you use. Your Extended Guarantee can start, either: when the 3 year or 90, mile manufacturer's warranty expires, or at any period up to 8 years old. You have the.

Banking Hours Of Bank Of America

ATM Hours. Hours vary at this location. Profile Image for William C., Financial Manage your Bank of America banking and Merrill investment accounts. Bank of America, one of the largest banking and financial services corporations in the United States. Customer service for lost or stolen cards is available 24 hours a day, 7 days a week. Banking products are provided by Bank of America, N.A., and affiliated. A Home Equity Line of Credit (HELOC) may provide the financial flexibility you need. Learn More. Online Banking. Login ID Password Sign In. Deposit checks from almost anywhere with the Bank of America Mobile Banking app Footnote[1] on your smartphone or tablet. Hill. Personal banking, Commercial banking, Investments, Loans and Credit Cards, Mortgage. Details. Telephone: () visit website. Hours. Monday, 9. Bank of America branches are typically open on weekdays from 9 a.m. to 5 p.m. Some branches open later at 10 a.m. and close earlier at 4 p.m.. On Saturdays. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Bank of America Checking & Savings customer service information is designed to make your banking experience easy and efficient. ATM Hours. Hours vary at this location. Profile Image for William C., Financial Manage your Bank of America banking and Merrill investment accounts. Bank of America, one of the largest banking and financial services corporations in the United States. Customer service for lost or stolen cards is available 24 hours a day, 7 days a week. Banking products are provided by Bank of America, N.A., and affiliated. A Home Equity Line of Credit (HELOC) may provide the financial flexibility you need. Learn More. Online Banking. Login ID Password Sign In. Deposit checks from almost anywhere with the Bank of America Mobile Banking app Footnote[1] on your smartphone or tablet. Hill. Personal banking, Commercial banking, Investments, Loans and Credit Cards, Mortgage. Details. Telephone: () visit website. Hours. Monday, 9. Bank of America branches are typically open on weekdays from 9 a.m. to 5 p.m. Some branches open later at 10 a.m. and close earlier at 4 p.m.. On Saturdays. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Bank of America Checking & Savings customer service information is designed to make your banking experience easy and efficient.

Bank of America is one of the Big Four banking institutions of the United States. It serves about 10 percent of all American bank deposits, in direct. View balances, make transfers, deposit checks with the Bank of America App. American Bank has branches throughout Texas and proudly offers commercial lending products, wealth management services and much more. Visit our website. A nationally chartered bank providing access to some of the highest CD (certificate of deposit) rates in the industry along with high-yield savings accounts. Financial Center Hours. Thursday AM - PM. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Log in to Online Banking. User ID Must be at least 6 characters long. Save this User ID. Online ID Help layer. Asia Pacific. Need help with your Bank of America credit card, loan or consumer banking account? Click here. Bank of America's sales office, separate ATM and virtual banking are conveniently located at Smith St STE Houston, TX American Bank has branches throughout Texas and proudly offers commercial lending products, wealth management services and much more. Visit our website. ATM Hours. Open 24 Hours. Profile Image for Amy C., Operations Analyst. "Doing right Manage your Bank of America banking and Merrill investment accounts. Our financial center with walk-up ATM in Bel Air offers extended hours and access to a full range of banking services and specialists for advice and guidance. Nurgul Ablyazova. Bank of America Icon. Small Business Banker. Merrill Edge Icon. Appointment. What would you like the power to do? For you and your family, your business and your community. At Bank of America, our purpose is to help make financial. ATM Hours. Open 24 Hours. Profile Image for Johan M., Senior Banker. "I love seeing Manage your Bank of America banking and Merrill investment accounts. Bank of America financial centers and ATMs in Florida are conveniently located near you. Find the nearest location to open a CD, deposit funds and more. Westamerica Bank is a regional community bank with over 70 branches and 2 trust offices in 20 Northern and Central California counties. Bank of Oklahoma Contact Information · Mortgage. Mortgage Customer Service is available during the following hours: Monday to Friday: 7 am to 6 pm (CT) · Business. Philadelphia is your home, it's our home too. President, Bank of America Philadelphia “Our vision in Greater Philadelphia as a business community is to ensure. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®.

What Is The Fastest Way To Earn Money Online

We've compiled some of the best ways you can make quick money from your computer, tablet, or phone. Whether this is your side hustle or just a way to earn money online fast from the comfort of your own home, learn everything you need to know about how you. Want to make money fast? Here are 16 legit ways to do it · 5. Sell clothes and accessories online · 6. Become a rideshare driver · 7. Make deliveries · 8. Perform. No need to pay for a specialized webinar or online course to learn how to do this. Swagbucks is one of the best online earning websites out there. And it allows. Make money doing what you do best using Instagram tools such as Branded Content, Badges in Live and Shopping. Discover ways to be creative and get paid. The most common ways to make money online are freelancing, selling fastest way to make money and that on your own terms and time. It takes some. Joining a focus group panel is a great way to make money quickly. Broadly speaking, a focus group is a group of random people who are asked about their interest. Top 30 Free & Easy Ways To Make Money Online Fast – Best Side Business Ideas in · 1. Blogging — Best to make money online Fast in Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. Explore areas like content creation. We've compiled some of the best ways you can make quick money from your computer, tablet, or phone. Whether this is your side hustle or just a way to earn money online fast from the comfort of your own home, learn everything you need to know about how you. Want to make money fast? Here are 16 legit ways to do it · 5. Sell clothes and accessories online · 6. Become a rideshare driver · 7. Make deliveries · 8. Perform. No need to pay for a specialized webinar or online course to learn how to do this. Swagbucks is one of the best online earning websites out there. And it allows. Make money doing what you do best using Instagram tools such as Branded Content, Badges in Live and Shopping. Discover ways to be creative and get paid. The most common ways to make money online are freelancing, selling fastest way to make money and that on your own terms and time. It takes some. Joining a focus group panel is a great way to make money quickly. Broadly speaking, a focus group is a group of random people who are asked about their interest. Top 30 Free & Easy Ways To Make Money Online Fast – Best Side Business Ideas in · 1. Blogging — Best to make money online Fast in Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. Explore areas like content creation.

The clickworker app displays appropriate jobs for you, so you can quickly get an overview of the available work and get busy earning money. Do you like to have your own business? Everybody is able to launch a startup but it's not much easy to grow it. You should have enough knowledge of managing an. Earn money quickly with engaging ads and in-app purchases and gather user Google Ads is an easy way to reach potential customers with online ads. Here is a list of easy ways you can earn money online, which means you can often set your own schedule and work from the comfort of your own dorm or your. This guide will focus on short- and long-term money-making ideas to make extra cash by relying on digital resources. IMPORTANT NOTICE! TOLOKA APPLICATION IS NOT DESIGNED FOR TOLOKA ANNOTATORS PLATFORM USERS. PLEASE DO NOT DOWNLOAD *** Toloka is an app for earning money. Affiliate Marketing. For many, this is the way they start making money on the internet. Affiliate Marketing is simple and easy to start. Just promote other. 5 Ways To Make Money Online Even If You're Broke · 1. Start a Free Online Merch Store · 2. YouTube Tutorial Videos · 3. Create and Sell Your Own Video Course · 4. To make sure we're rewarding good creators, we review your channel before you're accepted in the YouTube Partner Program. We also constantly review channels to. You can use Google AdSense to place ads on your website. This option is relatively easy as Google matches ads to your site based on your content and visitors. How it works: This is a popular website that can be helpful for freelancers. Know something about digital animation? You can work for someone who doesn't have. Fiverr is the best place to make money online for free. This website lets you offer any kind of service that you are good at and earn money from it. Getting. Here are 10 legitimate ways to earn money online: Freelancing, Freelancing is a great way to earn money online if you have a particular skill or talent. - **Swagbucks**: Earn points (Swagbucks) for doing tasks like taking surveys, watching videos, and shopping online. Points can be redeemed for gift cards or. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services,.. To earn money. This article aims to dive into and explore the numerous ways you can make money online in Nigeria, regardless of your experience level. After affiliate marketing, the next fastest way to make money online is by selling physical items. There are two ways to sell physical stuff online – I call. Swagbucks* is a fun site that pays you for completing short online tasks such as playing games. You can then exchange this for gift cards, cash via PayPal or. - **Swagbucks**: Earn points (Swagbucks) for doing tasks like taking surveys, watching videos, and shopping online. Points can be redeemed for gift cards or.

How To Fix Credit After Bankruptcy

Repairing Your Credit after Bankruptcy · Monitor credit report for accuracy · Make on-time payments on debts not included in your bankruptcy · Build credit with. Amazingly, your credit begins to rebuild immediately after filing a Chapter 7 bankruptcy petition. Credit reporting agencies begin purging negative data almost. How to rebuild credit after bankruptcy · Focus on existing bills · Consider a secured card · Monitor your credit reports and score · Be patient · Make a budget. Stephen Snyder, known as "the Bankruptcy Guy," is the expert on regaining credit after bankruptcy. He filed bankruptcy in and fully recovered in less than. 7 Steps to Rebuild Your Finances & Credit After Bankruptcy · Step 1: Rewrite Your Budget · Step 2: Set Up Savings · Step 3: The All-Cash Budget · Step 4: Ease. Rebuilding Credit After Bankruptcy · Make Timely Payments on All Your Bills · Apply for a New Line of Credit · Ask a Loved One to Co-Sign on a Credit Card or. Short Summary: · Typically, you can enhance your credit score within months after bankruptcy, with noticeable improvements as early as one year. You can start to improve your credit after bankruptcy by making all of your payments on time. Keep your debt load low, especially as compared to your available. Apply for New Credit. Obtaining new credit after bankruptcy will speed up the improvement to your credit score, as long as you do so carefully. It allows you to. Repairing Your Credit after Bankruptcy · Monitor credit report for accuracy · Make on-time payments on debts not included in your bankruptcy · Build credit with. Amazingly, your credit begins to rebuild immediately after filing a Chapter 7 bankruptcy petition. Credit reporting agencies begin purging negative data almost. How to rebuild credit after bankruptcy · Focus on existing bills · Consider a secured card · Monitor your credit reports and score · Be patient · Make a budget. Stephen Snyder, known as "the Bankruptcy Guy," is the expert on regaining credit after bankruptcy. He filed bankruptcy in and fully recovered in less than. 7 Steps to Rebuild Your Finances & Credit After Bankruptcy · Step 1: Rewrite Your Budget · Step 2: Set Up Savings · Step 3: The All-Cash Budget · Step 4: Ease. Rebuilding Credit After Bankruptcy · Make Timely Payments on All Your Bills · Apply for a New Line of Credit · Ask a Loved One to Co-Sign on a Credit Card or. Short Summary: · Typically, you can enhance your credit score within months after bankruptcy, with noticeable improvements as early as one year. You can start to improve your credit after bankruptcy by making all of your payments on time. Keep your debt load low, especially as compared to your available. Apply for New Credit. Obtaining new credit after bankruptcy will speed up the improvement to your credit score, as long as you do so carefully. It allows you to.

How to Rebuild Credit After Bankruptcy in Canada Tips to Stay Out of Debt · Pay Bills on Time · Get a Cell Phone on Contract · Get a Secured Credit Card · Apply. Credit bureaus consider the most recent information to be the most important, so as you reestablish credit and pay your bills on time, your credit score will. 5 Tips to Improve Your Credit Score After Bankruptcy · 1. Make payments on time. · 2. Apply for a secured credit card. · 3. Request copies of your credit reports. Make sure your credit score is correct before you apply for a loan. Don't just assume your creditors will do what they are supposed to do, which is to correctly. If you're talking about CH7, then in about days from date of filing you'll receive your discharge. After that, you'll want to check your. That means that your debt to income ratio will improve, improving your score in that regard. Your late payment history on those accounts will diminish over time. If the unsecured debt amount you owe is almost hitting your credit limit, it will likely harm your credit score. To prevent this, you must increase your credit. What Should You Do to Restore Your Credit? · Review your credit report for errors and fix them right away. · Stay on top of all remaining accounts. · Create a. The law states that credit reporting agencies may not report a bankruptcy case on a person's credit report after ten (10) years from the date the bankruptcy. How to rebuild your credit. When you experience a financial challenge Chapter 7 bankruptcy. 10 years. Foreclosure. 7 years. Lawsuits and judgments. 7. Answer: While the task may seem daunting, it's absolutely possible to rebuild your credit score following a bankruptcy. In fact, when handled properly, many. It generally takes months before your credit improves after bankruptcy. FindLaw reviews what you need to know, how to improve your credit score. Rebuilding Credit After Bankruptcy · Make Timely Payments on All Your Bills · Apply for a New Line of Credit · Ask a Loved One to Co-Sign on a Credit Card or. Rebuilding Your Credit After Bankruptcy · Check Your Credit Report · Create a Budget · Open a Secured Credit Card · Apply for a Credit-Builder Loan · Become an. Here Are Some Steps To Help You Rebuild After Bankruptcy · When you receive a legitimate bill for anything, pay it before the due date. · Open a secured credit. Repair Your Credit After Bankruptcy Like the Pros: How to restore your credit, raise your credit score, and qualify to buy a home using legal strategy. Bankruptcy - how to revive your credit after hard times? How do I get my free credit report and score from each bureau? Popular Forum. At Leinart Law Firm, we're committed to helping you navigate the complexities of credit repair after bankruptcy. Contact us today for a personalized. Repair Your Credit After Bankruptcy Like the Pros: How to restore your credit, raise your credit score, and qualify to buy a home using legal strategy. Keep Up With Payments on Existing Loans and Credit Cards. The best way to rebuild your credit after bankruptcy is by making timely payments on existing loans.